Navigating the conversion of 200 Russian rubles (RUB) to US dollars (USD) in March 2025 requires careful consideration due to the ruble's volatility and the complexities of international finance. This guide provides a step-by-step approach to mitigate risks and optimize your exchange. For more on currency conversions, see this helpful resource.

Understanding RUB/USD Exchange Rate Fluctuations

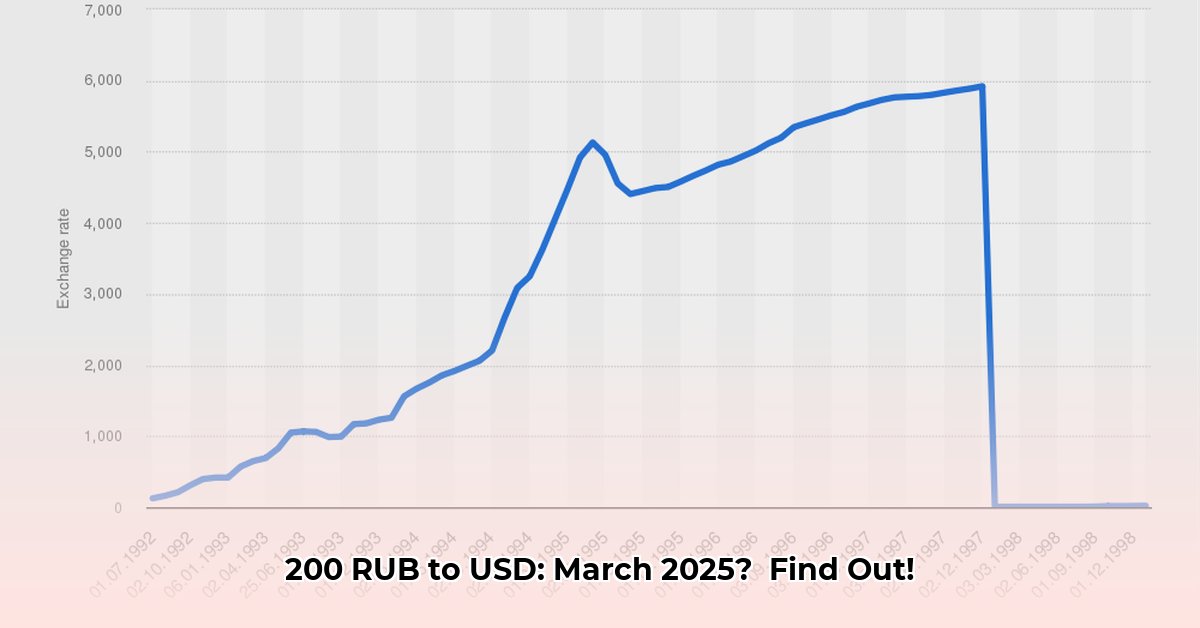

The RUB/USD exchange rate is notoriously volatile, influenced by geopolitical events, economic sanctions, and the overall health of the Russian economy. Predicting the precise conversion rate for your 200 RUB is impossible, highlighting the need for strategic planning and risk mitigation. Recent data reveals significant daily fluctuations, emphasizing the need for informed decision-making. How can you best navigate this unpredictable market?

Factors Influencing the Ruble's Value

Several key factors contribute to the ruble's instability. International relations, specifically sanctions imposed on Russia, significantly impact the currency's value. Domestic economic conditions within Russia play a crucial role, further adding to the uncertainty. This dynamic landscape makes accurate forecasting challenging, similar to predicting weather patterns with absolute certainty.

A Step-by-Step Guide to Converting 200 RUB to USD

Given the current climate, directly converting RUB to USD may prove difficult. The following steps offer a more robust approach:

Explore Alternative Conversion Paths: Consider using intermediary currencies like the Euro (EUR) or British Pound (GBP) to facilitate the transaction. This strategy can increase the likelihood of a successful exchange, much like taking a detour to avoid road closures.

Prioritize Transparency: Choose reputable money exchange services with clearly defined fees. Hidden charges can significantly reduce your final amount. Scrutinize fee structures before committing to any service.

Monitor Exchange Rates: Regularly track the RUB/USD exchange rate using reliable sources (1 Wise.com, for example) to identify optimal conversion points. Timing your transaction strategically can minimize losses.

Seek Professional Advice: For significant sums or if feeling overwhelmed, consult a financial advisor specializing in international transactions. Their expertise can navigate the complexities of currency exchange and risk mitigation.

Risk Assessment Matrix

Different conversion methods present various levels of risk:

| Method | Risk of Fraud/Scam | Risk of Regulatory Changes | Risk of Exchange Rate Fluctuations |

|---|---|---|---|

| Direct RUB/USD Transfer | Low (if available) | High | High |

| Third-Party Currency Transfers | Moderate | Moderate | Moderate |

| Peer-to-Peer Platforms | High | Moderate | High |

Direct RUB/USD conversion, if even feasible, carries the highest overall risk. Utilizing intermediary currencies significantly reduces the impact of these risks.

Mitigating Volatility Using Third-Party Currencies

Using a more stable currency, like the Euro or Swiss Franc, as an intermediary between RUB and USD can mitigate volatility. This approach provides a buffer against significant exchange rate swings, like using a shock absorber to smooth a bumpy ride.

Key Considerations:

- Currency Selection: Choose a stable currency with low volatility against both RUB and USD.

- Transaction Timing: Execute transactions when exchange rates are favorable.

- Fee Comparison: Compare total costs across different service providers.

Long-Term Financial Planning: Diversification

For long-term financial health, diversification is paramount. Don't concentrate your assets solely in one currency. Strategic diversification across various currencies and asset classes helps mitigate risks.

Call to Action: Monitor exchange rates diligently, explore alternative transfer methods, and seek professional advice when needed. Informed decision-making is key to successful navigation of the RUB/USD exchange market.